- en

- fr

/News

01/13/2021

FIRST CLOSING ON €200m FOR MMF6

PRESS RELEASE

Paris, January 13, 2021 - Azulis Capital ("Azulis"), one of France's leading independent mid-market private equity firms, announces the first closing of its sixth fund, Middle Market Fund 6 (MMF 6) at €200m.

Pierre Jourdain, Chairman of the Management Board, comments: "It is a great pleasure for the entire Azulis team to have successfully completed a first closing of this size in such a special context and we thank our investors for their trust. This success confirms the strategy we have been implementing for more than 25 years: selective investments in four sectors of the real economy, a high-level team completely fulfilling its shareholder position, and strong commitments in terms of CSR (Corporate Social Responsibility), which have enabled our portfolio companies to withstand the crisis well. We are very confident that we will reach our target of €250m or more in the coming months.

Four resilient sectors

Alike its predecessors, this new fund will be invested in four key sectors: health and personal services, food & beverages, consumer and business services.

MMF 6 will take both majority or minority stakes between €10m and €20m in high-potential companies ranging from €20m to €120m enterprise value. The fund will have a capacity to underwrite up to €50m of equity, with the support of its subscribers who may co-invest alongside Azulis.

As a partner, Azulis proposes to activate several levers to promote sustainable growth: build-up, internationalisation, transformation and improved governance. Azulis also stands out for its structured ESG (Environment, Social, Governance) approach, at the heart of value creation: the team supports its companies using a proven methodology to define and implement an ambitious and impactful CSR strategy.

Azulis' historical investors - institutional investors, family offices and entrepreneurs - have responded very positively, convinced by a well-tested model and judiciously chosen sectors that have proven their resilience.

An intense year 2020, a sustained outlook

Despite the crisis, the year 2020 has been very active for Azulis. The team, which is now composed of ten investment professionals, including eight partners, has been very involved to assist the managers in dealing with this unprecedented situation. At the end of 2020, the portfolio was generally resilient. 12 build-ups were completed in the portfolio and several opportunities are underway.

There was also a lot of activity in terms of disposals: Vivalto Vie was sold in April to a pool of financial investors along with the management and the historical financial partners; LaBoutiqueOfficielle.com was also sold in August to a Luxembourg fund associated with other financial partners and the management, with a reinvestment from the MMF V fund. The closing of Marcel & Fils should be finalised in February.

The year 2021 also promises to be intense, with new disposals from the MMF IV and MMF V portfolios, the finalisation of the closing of MMF 6, and new acquisitions fuelled by a strong deal flow. The first investment of this new fund will be made in the coming weeks.

12/23/2020

2020 ESG REPORT

Azulis Capital publishes its 2020 ESG report.

Download the PDF report in the section Responsible investor.

10/12/2020

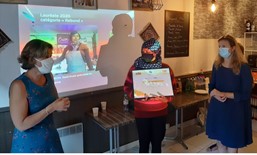

CREADIE 2020 TROPHIES AWARDED

The 2020 edition was placed under the sign of resilience and social responsibility

Astrid Cloarec and Donatien Noyelle awarded 2 nominees and 6 special wawards for their fighting spirit, their resilience, and the impact of their commitment on their own lives and their territory.

- Prix “Rebond”: Alexandra Ruffier, 39 years old, mobile grocery shop selling organic and local products in bulk, Franche-Comté

- Prix “Vitalité des territoires”: Rebecca Namboue, 25 years old, African cuisine home-based caterer, Hauts-de-France

Azulis Capital's special prizes 2020 :

- Alain Aldrin, 65 years old, foodtruck of local burgers, Burgundy

- Coralie Lancry, 29 years old, Eco-responsible cosmetics, Martinique

- Samiya Chambon, 47 years old, Somalian cuisine foodtruck, Pays de la Loire

- Jean-Baptiste Tearaitua Tavanae, 31 years old, organic farming, French Polynesia

- Camille Lannoy, 28 years old, cosmetic products made from goat's milk, Occitania

- Latifa Boulaich, 49 years old, Oriental cuisine caterer, New Aquitaine

Fabienne Kerzhero (Head of Adie Pays de la Loire) and Astrid Cloarec, Investment Director at Azulis Capital, aeward Samiya Chambon for her Somalian cuisine foodtruck project in Nantes

For further information, please visit the Sponsorship Action page, Adie section.

12/24/2019

2019 ESG REPORT

Azulis Capital publishes its 2019 ESG report.

Download the PDF report in the section Responsible investor.